An emergency fund acts as a financial safety net for unexpected expenses. It offers stability and peace of mind during life’s surprises. Unlike regular savings or investments, this fund should be easily accessible when needed. Typical uses cover medical expenses, car repairs, or unexpected job loss. Unlike other financial tools, an emergency fund is specifically designed to shield you from financial stress.

The Appeal of Credit Cards

Credit cards are convenient. They offer quick access to funds during emergencies. Rewards, cash-back, and travel perks make them even more attractive. For many, it may feel natural to rely on a credit card instead of maintaining a separate emergency fund. After all, it is there when you need it. However, this approach can lead to long-term financial challenges.

Credit cards are convenient. They offer quick access to funds during emergencies. Rewards, cash-back, and travel perks make them even more attractive. For many, it may feel natural to rely on a credit card instead of maintaining a separate emergency fund. After all, it is there when you need it. However, this approach can lead to long-term financial challenges.

The Importance of Liquidity

Liquidity refers to how easily assets can be converted into cash. Emergency funds are typically held in savings accounts or money market accounts, making them immediately accessible. Credit cards, however, require borrowing and subsequent repayment. While cash advances are an option, they come with high fees and interest rates. Ensuring funds are liquid is critical when urgent needs arise.

The True Financial Security

Building an emergency fund requires deliberate planning. Financial advisors recommend saving three to six months’ worth of living expenses. This fund should be separate from retirement accounts or long-term investments. By having dedicated savings, you are prepared for unforeseen events without derailing your financial goals. It also creates a buffer that credit cards cannot match, providing a unique advantage in financial planning.

High-Interest Rates and Debt Risk

One of the biggest drawbacks of using credit cards as a safety net is the high-interest rates. Carrying a balance can quickly turn a small emergency into a large debt. For example, a $1,000 emergency can grow significantly if only minimum payments are made. Over time, interest charges accumulate, making it difficult to regain financial stability. An emergency fund, in contrast, eliminates this risk entirely.

Emotional and Psychological Factors

Relying on credit cards in emergencies can create stress. Balances mount, and monthly payments can feel overwhelming. This emotional burden often impacts decision-making, leading to additional spending or borrowing. An emergency fund removes this worry. Knowing you have liquid cash available provides a sense of control and confidence that a credit card simply cannot replicate.

When Credit Cards Can Complement an Emergency Fund

Credit cards are not inherently bad. They can complement an emergency fund when used responsibly. For example, small emergencies or temporary cash flow gaps can be managed with a credit card if repayment is immediate. Additionally, rewards and protections offered by cards can add value. The key is to avoid using credit as a primary safety net, as it cannot replace the security of dedicated savings.

Creating a sustainable emergency fund starts with small, consistent contributions. Automating savings ensures progress and reduces the temptation to spend the money. Regularly reviewing the fund helps ensure it grows in line with your expenses and lifestyle changes. By prioritizing your emergency fund, you establish a financial foundation that supports long-term stability. This approach is the most reliable way to face unexpected challenges, far beyond what a credit card can provide.…

If you’re single and have no dependents, your emergency fund needs may be simpler to navigate. The good ol’ rule of thumb suggests having three to six months’ worth of living expenses saved up. This amount provides a solid buffer against unexpected job loss or medical bills. Start by calculating your monthly expenses. Consider rent, groceries, utilities, and transportation costs. Once you know the total, multiply it by three for a basic safety net. Building this fund can be done gradually.

If you’re single and have no dependents, your emergency fund needs may be simpler to navigate. The good ol’ rule of thumb suggests having three to six months’ worth of living expenses saved up. This amount provides a solid buffer against unexpected job loss or medical bills. Start by calculating your monthly expenses. Consider rent, groceries, utilities, and transportation costs. Once you know the total, multiply it by three for a basic safety net. Building this fund can be done gradually.

The first step in selecting a trustworthy crypto service is evaluating its reputation and credibility. Research the company’s history, track record, and user reviews. A reputable service provider should have a transparent history of operations and positive feedback from its user base. Look for endorsements or reviews from industry experts, and check if the service has been involved in any controversies or security breaches. A well-established provider with a strong reputation will likely offer reliable and secure services.

The first step in selecting a trustworthy crypto service is evaluating its reputation and credibility. Research the company’s history, track record, and user reviews. A reputable service provider should have a transparent history of operations and positive feedback from its user base. Look for endorsements or reviews from industry experts, and check if the service has been involved in any controversies or security breaches. A well-established provider with a strong reputation will likely offer reliable and secure services.

Understanding the fee structure of a

Understanding the fee structure of a

When the prospect of

When the prospect of

Before making any business decisions, it’s important to understand the market clearly. This means identifying your target audience and researching their needs, preferences, and behaviors. To start with the research process, you can use various tools such as surveys or focus groups to gain insights into what drives consumer behavior. Once you have collected data on your existing customer base, looking at potential customers is essential.

Before making any business decisions, it’s important to understand the market clearly. This means identifying your target audience and researching their needs, preferences, and behaviors. To start with the research process, you can use various tools such as surveys or focus groups to gain insights into what drives consumer behavior. Once you have collected data on your existing customer base, looking at potential customers is essential. If you want to stay ahead of the game and accurately analyze market trends, keeping a close eye on relevant news and events is important. This means staying up-to-date with industry publications, attending conferences and seminars, following key influencers in your field on social media platforms, among other things. By monitoring relevant news and events, you can gain valuable insights about emerging trends in your industry.

If you want to stay ahead of the game and accurately analyze market trends, keeping a close eye on relevant news and events is important. This means staying up-to-date with industry publications, attending conferences and seminars, following key influencers in your field on social media platforms, among other things. By monitoring relevant news and events, you can gain valuable insights about emerging trends in your industry.

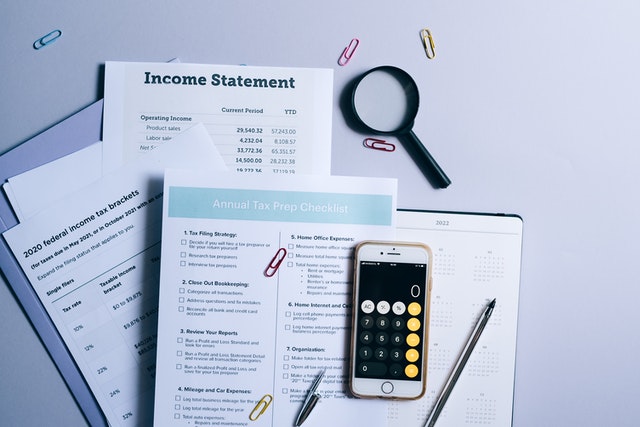

Your income proof is another vital document that you will need to submit. This document will aid the lender in determining your loan repayment ability. Pay stubs, tax returns, and bank statements are all acceptable forms of proof of income. If you are self-employed, you will need to produce additional paperwork, such as financial statements or tax returns.

Your income proof is another vital document that you will need to submit. This document will aid the lender in determining your loan repayment ability. Pay stubs, tax returns, and bank statements are all acceptable forms of proof of income. If you are self-employed, you will need to produce additional paperwork, such as financial statements or tax returns.

Once you have the money you need to grow your business, it’s essential to use it wisely. You don’t want to waste your hard-earned cash on things that won’t help you reach your goals. Instead, focus on investing in areas that will allow you to scale up and reach new customers.

Once you have the money you need to grow your business, it’s essential to use it wisely. You don’t want to waste your hard-earned cash on things that won’t help you reach your goals. Instead, focus on investing in areas that will allow you to scale up and reach new customers.

The first factor you should consider is the amount of money you will pay for a home insurance package. Money is always an essential factor when it comes to insurances. It is necessary to note that insurance companies are just like other businesses; they have a primary goal of making more profit.

The first factor you should consider is the amount of money you will pay for a home insurance package. Money is always an essential factor when it comes to insurances. It is necessary to note that insurance companies are just like other businesses; they have a primary goal of making more profit. The second factor you should consider when choosing an insurance company for your home is experience. To some people, experience may not be an important factor to consider. You should know that experience will play a significant role in determining the quality of services an insurance company offers.

The second factor you should consider when choosing an insurance company for your home is experience. To some people, experience may not be an important factor to consider. You should know that experience will play a significant role in determining the quality of services an insurance company offers.

You should note that financial advisors have the expertise and experience required by a business to make most out of its capital investment. For instance, they can help outline the timelines and strategies for you to achieve profitability. Moreover, they can assess the viability of your business. The following are some ways financial advisors can accelerate, improve, and ensure you achieve business success.

You should note that financial advisors have the expertise and experience required by a business to make most out of its capital investment. For instance, they can help outline the timelines and strategies for you to achieve profitability. Moreover, they can assess the viability of your business. The following are some ways financial advisors can accelerate, improve, and ensure you achieve business success. A financial advisor can help you to be in control of your enterprise’s path. Unless you are an expert already, hiring a reputable advisor can help you save both money and time. Whenever you spend adequate time performing various functions that are not your abilities, you deny the business the much-needed expertise. Fortunately, when you work with a financial advisor, you get the expert help you need. Thus, complex tasks can be done quickly, and you can make the right decisions concerning money.

A financial advisor can help you to be in control of your enterprise’s path. Unless you are an expert already, hiring a reputable advisor can help you save both money and time. Whenever you spend adequate time performing various functions that are not your abilities, you deny the business the much-needed expertise. Fortunately, when you work with a financial advisor, you get the expert help you need. Thus, complex tasks can be done quickly, and you can make the right decisions concerning money.

There are times that you might only look into the present situation and assess it without giving it a second thought.

There are times that you might only look into the present situation and assess it without giving it a second thought. The sources from where you get your financial information matters a great deal. This is why you have to be extremely selective when it comes to the sources you rely upon.

The sources from where you get your financial information matters a great deal. This is why you have to be extremely selective when it comes to the sources you rely upon.

Is not advisable that you keep all your holdings in one account. Have different accounts, example, have one where you do all your transactions and one where you have your savings. This will reduce the risk of losing everything in case of any unauthorized user getting access to your account. Bitcoin does not limit the number of accounts or addresses one user may have. This makes it somehow convenient in ensuring security for your money.

Is not advisable that you keep all your holdings in one account. Have different accounts, example, have one where you do all your transactions and one where you have your savings. This will reduce the risk of losing everything in case of any unauthorized user getting access to your account. Bitcoin does not limit the number of accounts or addresses one user may have. This makes it somehow convenient in ensuring security for your money. Having your Bitcoin wallet on your computer does not assure your safety for your holdings. Attacks can still reach your Bitcoin wallet; this is because these wallets store their data in a predictable location. This increases the risk of your money getting lost in the Bitcoin. To ensure protection against any attack on your Bitcoin wallet, it would be best to adopt an offline medium. An offline medium acts as added security over your Bitcoin wallet.

Having your Bitcoin wallet on your computer does not assure your safety for your holdings. Attacks can still reach your Bitcoin wallet; this is because these wallets store their data in a predictable location. This increases the risk of your money getting lost in the Bitcoin. To ensure protection against any attack on your Bitcoin wallet, it would be best to adopt an offline medium. An offline medium acts as added security over your Bitcoin wallet.

The first and essential thing you should first look in a shylock is if they are concern about your needs. You first need to know that the real estate industry is a complicated one and this, consequently, implies that if you are a newcomer in the industry, the possibility of you getting into confusion is very high.

The first and essential thing you should first look in a shylock is if they are concern about your needs. You first need to know that the real estate industry is a complicated one and this, consequently, implies that if you are a newcomer in the industry, the possibility of you getting into confusion is very high. The best company to take is those companies with an insurance policy, which covers the loan you are requesting. In any case, if you die before repurchasing the investment the insurance will take the paying back role of the money. These will prevent attachment of your personal properties as the securities to the loan. These will not only give you the assurance that you have chosen the right but the one that mind your financial status. The best produce the best make sure you insist on the best that will provide the quality.…

The best company to take is those companies with an insurance policy, which covers the loan you are requesting. In any case, if you die before repurchasing the investment the insurance will take the paying back role of the money. These will prevent attachment of your personal properties as the securities to the loan. These will not only give you the assurance that you have chosen the right but the one that mind your financial status. The best produce the best make sure you insist on the best that will provide the quality.…